bitcoin ethereum altcoin cycle Understanding Trends

Kicking off with bitcoin ethereum altcoin cycle, it's essential to understand how the cryptocurrency market navigates through its various phases, often marked by the ebbs and flows of Bitcoin, Ethereum, and altcoins. These cycles not only shape investment strategies but also reflect shifting market sentiments and technological advancements that continuously redefine the landscape.

As we delve deeper, we will explore the intricate relationship between Bitcoin's dominance and altcoin movements, the unique dynamics of Ethereum’s market, and the key altcoins that have historically made significant impacts during these cycles. Understanding these elements helps investors make informed decisions in a rapidly changing environment.

Overview of Cryptocurrency Cycles

The cryptocurrency market is known for its volatility and cyclical nature, with periods of rapid price increases followed by corrections. Understanding these cycles is essential for investors and traders alike, as they often dictate the optimal times to enter or exit positions. The significance of market cycles lies in their ability to reflect broader trends, investor sentiment, and technological advancements within the cryptocurrency ecosystem.A typical altcoin cycle generally consists of several phases, including accumulation, mark-up, distribution, and decline.

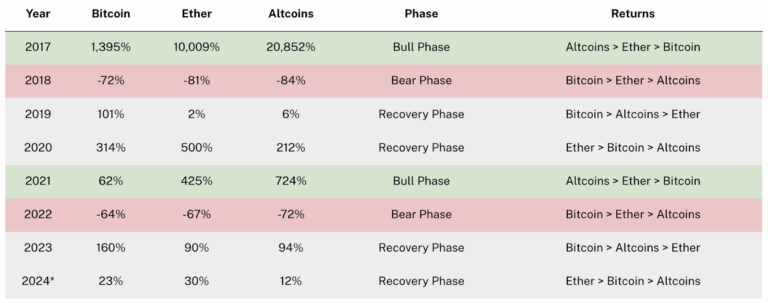

During the accumulation phase, savvy investors buy into altcoins when prices are low, often following Bitcoin's price stability. The mark-up phase sees prices rise sharply as more investors join the market, largely influenced by Bitcoin and Ethereum’s performance. Historical examples, such as the 2017 bull run, illustrate how altcoins can surge dramatically after Bitcoin reaches new heights, creating a ripple effect throughout the market.

Bitcoin's Role in the Altcoin Cycle

Bitcoin serves as the cornerstone of the cryptocurrency market, often dictating the price movements of altcoins during cycles. When Bitcoin experiences significant price fluctuations, altcoins typically follow suit, either amplifying gains or exacerbating losses. This correlation is heightened in times of market exuberance or panic, where Bitcoin's dominance often plays a crucial role in shaping altcoin investments.Bitcoin dominance, the measure of Bitcoin's market capitalization relative to the total cryptocurrency market, significantly affects altcoin investments.

A rising Bitcoin dominance often leads to a decrease in altcoin prices, as investors flock to Bitcoin for its perceived stability. Data from previous cycles show that while Bitcoin maintains its status as a market leader, Ethereum and select altcoins have occasionally outperformed Bitcoin in terms of percentage gains during bullish phases.

Ethereum's Market Dynamics

Ethereum's unique characteristics, such as its smart contract functionality and robust ecosystem, influence its market cycle distinctively compared to Bitcoin. While Bitcoin is primarily viewed as a store of value, Ethereum’s diverse applications—from decentralized finance (DeFi) to non-fungible tokens (NFTs)—allow for unique market dynamics that often lead to different price trajectories during cycles.When comparing Ethereum's price fluctuations with Bitcoin's during altcoin cycles, it is evident that Ethereum often exhibits higher volatility.

This volatility can be attributed to its varying use cases and the influx of new projects built on its blockchain. The network's ongoing upgrades and developments, such as the transition to Ethereum 2.0, further enhance its appeal and impact its market cycle, driving interest and investment.

Trends in Altcoins

Several key altcoins have historically demonstrated significant price movements during cycles, often outpacing Bitcoin and Ethereum. These altcoins include:

- Litecoin (LTC)

- Ripple (XRP)

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

Factors that drive altcoin popularity during cycles include technological innovation, strong community support, and strategic partnerships. For instance, Solana saw remarkable growth during the last cycle due to its high throughput and low transaction fees, making it a favorite among DeFi projects. Similarly, Cardano's emphasis on academic research and sustainability garnered attention, leading to significant price appreciation.

Market Sentiment and Its Impact

Market sentiment plays a critical role in influencing altcoin cycles. Bullish sentiment can lead to rapid price increases, while bearish sentiment often results in sharp declines. Understanding these sentiments allows traders to better navigate the market landscape.Methods to gauge market sentiment include monitoring social media trends, analyzing trading volumes, and observing price movements on trading platforms. Sentiment analysis tools have become increasingly popular, providing insights based on various data points.

| Trend Indicator | Bullish Scenario | Bearish Scenario |

|---|---|---|

| Social Media Mentions | High volume of positive mentions | High volume of negative mentions |

| Trading Volume | Increased buying activity | Increased selling activity |

| Price Movement | Consistent upward trend | Consistent downward trend |

Risk Management in Trading Cycles

Managing risks during altcoin cycles is essential for preserving capital and maximizing returns. Investors should adopt strategies that diversify their portfolios across different cryptocurrencies to mitigate potential losses. This approach reduces exposure to any single asset's volatility.Setting stop-loss orders is crucial in volatile markets, allowing traders to automatically exit positions when prices fall to a predetermined level. Similarly, establishing profit targets can help secure gains during favorable market conditions.

By employing these risk management techniques, traders can navigate the complexities of altcoin cycles more effectively.

Future Predictions and Trends

Future trends in Bitcoin, Ethereum, and altcoin cycles suggest increased volatility and potential growth driven by technological advancements and regulatory developments. Emerging altcoins that could play a significant role in the next cycle include Layer 2 solutions and privacy-centric cryptocurrencies, which address scalability and user privacy concerns.Technological advancements, such as improved blockchain interoperability and the rise of decentralized applications (dApps), are likely to impact cryptocurrency cycles significantly.

As the market evolves, investors should remain vigilant and adapt their strategies to capitalize on new opportunities and challenges that arise within the digital asset landscape.

Epilogue

In conclusion, the bitcoin ethereum altcoin cycle is a fascinating interplay of market forces that requires careful analysis and understanding. By examining past trends, evaluating current market sentiments, and anticipating future developments, investors can better position themselves to navigate the complexities of the cryptocurrency landscape, ensuring they're ready to capitalize on the next wave of opportunities.

Helpful Answers

What is an altcoin cycle?

An altcoin cycle refers to a period where alternative cryptocurrencies experience significant price movements, often influenced by Bitcoin's performance.

How does Bitcoin dominance affect altcoins?

Bitcoin dominance reflects its market share; a higher dominance often indicates altcoins are less likely to perform well, while lower dominance can lead to altcoin rallies.

What role does market sentiment play in altcoin cycles?

Market sentiment significantly impacts altcoin cycles, as positive news can drive prices up, while negative sentiment can lead to declines across the market.

How can I gauge market sentiment for altcoins?

You can gauge market sentiment through social media trends, trading volume analysis, and sentiment analysis tools that track community discussions.

What are some strategies for investing in altcoins?

Strategies include diversifying investments, setting clear stop-loss orders, and staying updated on market trends to make informed decisions.